Master Financial Analysis Through Practice

Build real skills with Australia's most comprehensive hands-on financial analysis program. Start your journey in September 2025.

Why This Program Works

We've spent years watching students struggle with theoretical finance courses that don't translate to real work. That's why we built something different.

You'll work with actual company data from day one. No made-up scenarios or simplified examples. Real balance sheets, real cash flow statements, real problems that financial analysts solve every day.

Our approach focuses on building muscle memory. You'll run through the same types of analysis dozens of times with different companies until it becomes second nature. That's how you get genuinely good at this stuff.

What You'll Actually Learn

Financial Statement Deep Dive

Break down income statements, balance sheets, and cash flow statements. Learn to spot the stories numbers tell and the red flags they reveal. Practice with companies from mining to tech startups.

Ratio Analysis That Matters

Move beyond basic ratios to industry-specific metrics. Understand what ratios actually mean for different business models and when they're misleading. Build your own analysis framework.

Valuation Methods

DCF models, comparable company analysis, and precedent transactions. Learn when to use each method and more importantly, when not to. Practice with real deal scenarios from the Australian market.

Industry-Specific Analysis

Mining companies need different analysis than retail chains. Banks follow different rules than tech companies. Learn the nuances that make analysis meaningful in each sector.

Risk Assessment

Credit risk, operational risk, market risk. Learn to quantify uncertainty and communicate risk levels clearly. Practice with case studies from companies that succeeded and failed.

Professional Communication

Write reports that actually get read. Present findings that influence decisions. Learn to explain complex analysis in terms that make sense to different audiences.

Learn From People Who've Done This

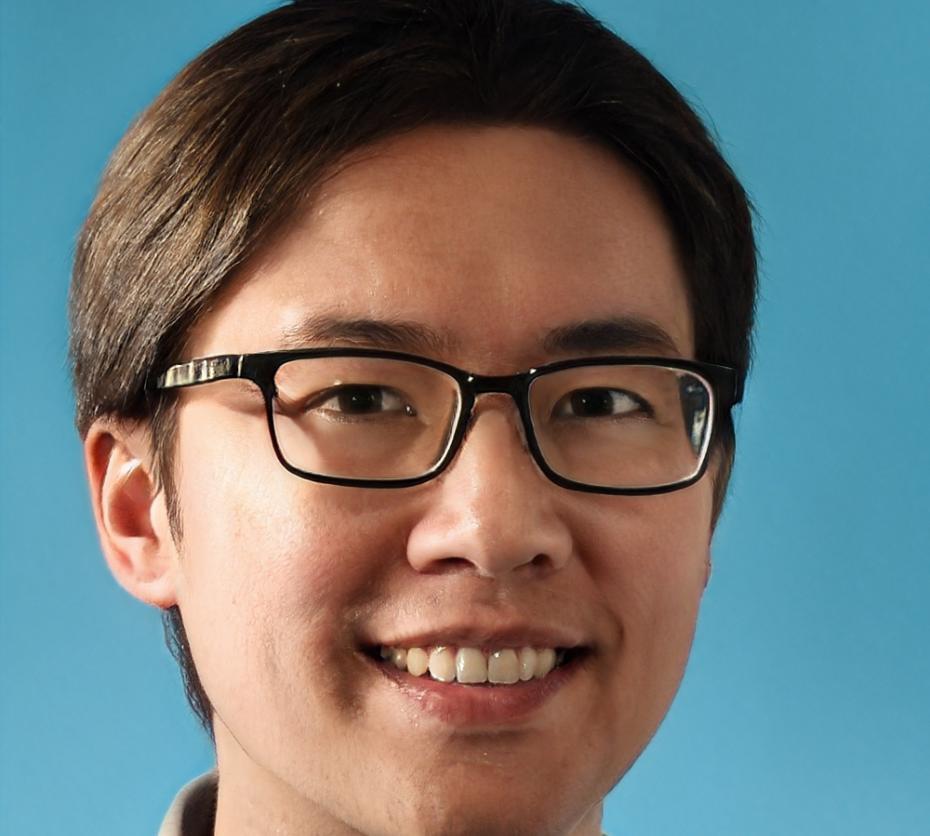

Marcus Chen

Senior Financial Analyst

Spent eight years at Macquarie analyzing mining deals. Now runs due diligence for a mid-market private equity fund. Still gets excited about finding hidden value in overlooked companies.

Sarah Williams

Investment Director

Built financial models for some of Australia's largest infrastructure projects. Now evaluates investment opportunities for a major superannuation fund. Believes the best analysis tells a clear story.

David Park

Credit Risk Manager

Started in corporate banking, moved to risk management at one of the big four banks. Specializes in teaching people to see what financial statements don't say as much as what they do.

Tools You'll Master

We don't just teach theory. You'll get hands-on experience with the same software and databases that professionals use every day.

- Advanced Excel modeling techniques and shortcuts

- Bloomberg Terminal access for market data

- FactSet for company research and screening

- Capital IQ for deal comparisons

- Python basics for data analysis automation

- Industry databases and research platforms